Fake Crash Investigation

Staged Collisions, Fraudulent Claims & Vehicle Theft Investigations

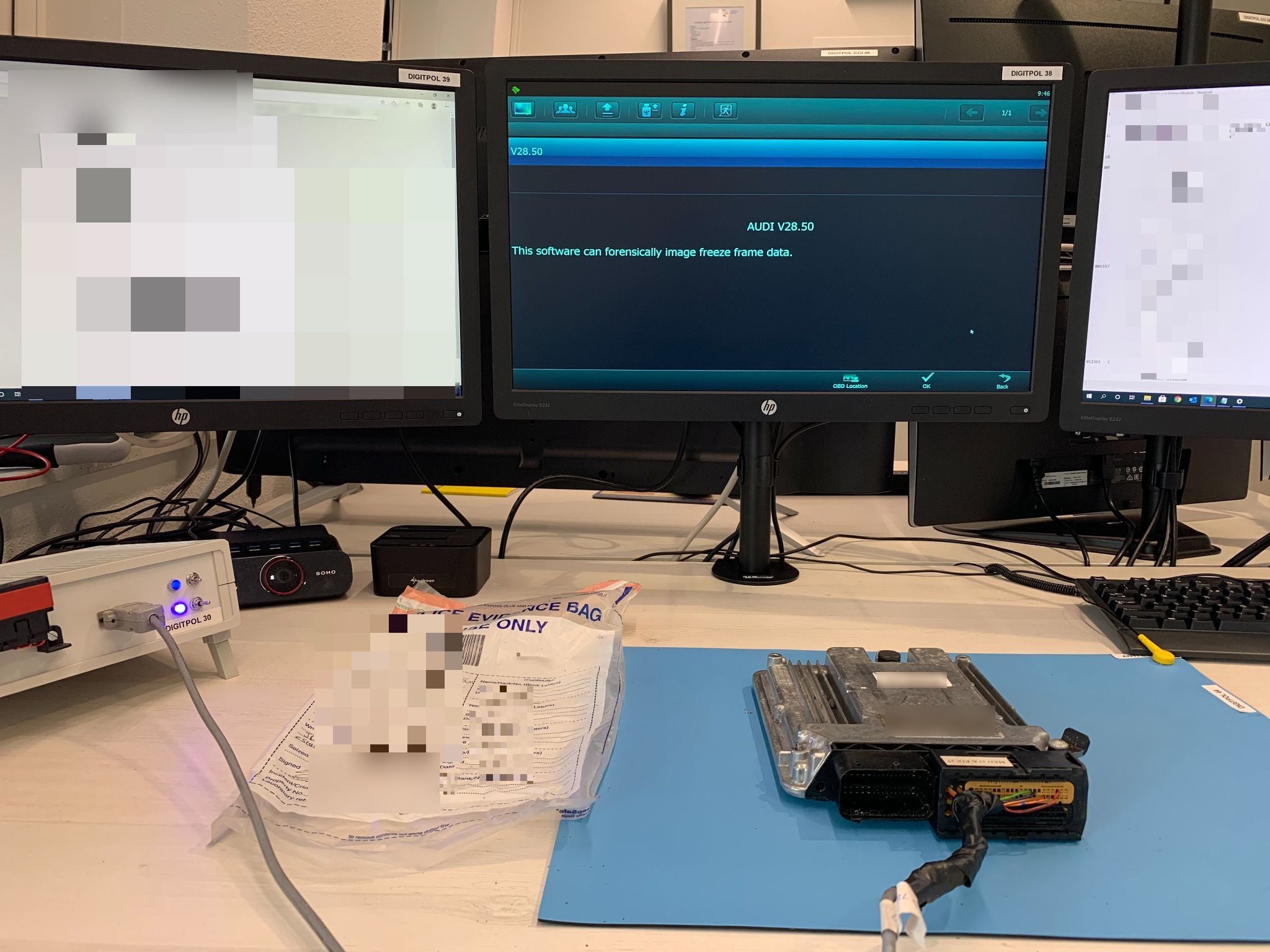

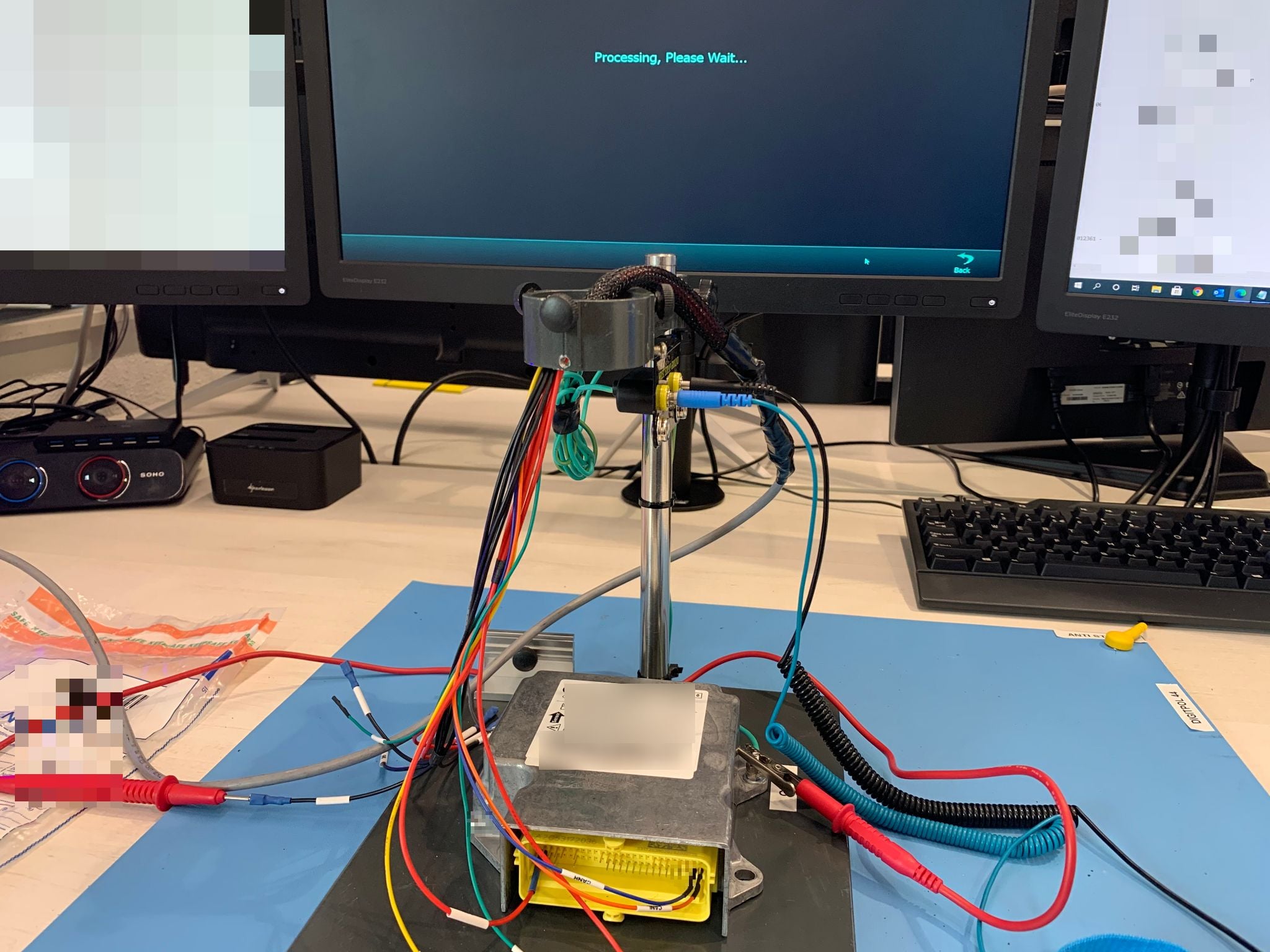

Staged collisions and fraudulent insurance claims continue to pose significant challenges, affecting both individuals and the wider public by driving up insurance premiums. Digitpol’s specialist vehicle forensics teams are dedicated to validating the authenticity of motor insurance claims. We ensure that the reported vehicle damage aligns with the described incident by applying advanced digital forensic methods.

Through forensic data extraction from vehicle control modules, our experts retrieve key evidence such as engine temperature, mileage, speed, and event timestamps to determine whether a collision was genuine or staged. This digital evidence plays a critical role in confirming or disproving fraudulent claims.

Digitpol also tackles the increasing problem of keyless vehicle theft, where offenders exploit vulnerabilities in keyless entry systems through relay attacks to steal high-end vehicles. Our forensic analysis enables insurers to verify whether the key presented during an insurance claim truly corresponds to the stolen vehicle, frequently uncovering inconsistencies that expose fraudulent activity.

Combining digital forensics, intelligence gathering, and covert surveillance, Digitpol delivers comprehensive investigations that help insurers identify deception, recover stolen vehicles, and ensure that only legitimate claims are processed.

Our Solutions

Digital Detection of Crash Data

We are experts in the analysis of “staged collisions” and can recover the evidence if a collision was recorded.

Recover the VIN from the suspected key

We specialise in recovery of identity numbers from transponder chips embedded into modern keys.

Analyse the Crash Speed

We can recover the digital Crash Speed and parameters at the time of the collision.